CRM for accountants

Modern accounting and financial management require accuracy, transparency, and strict data control. A customized CRM system for accountants allows you to organize financial information, automate routine operations, and ensure complete control over accounting, reporting, and interactions with clients or internal company departments.

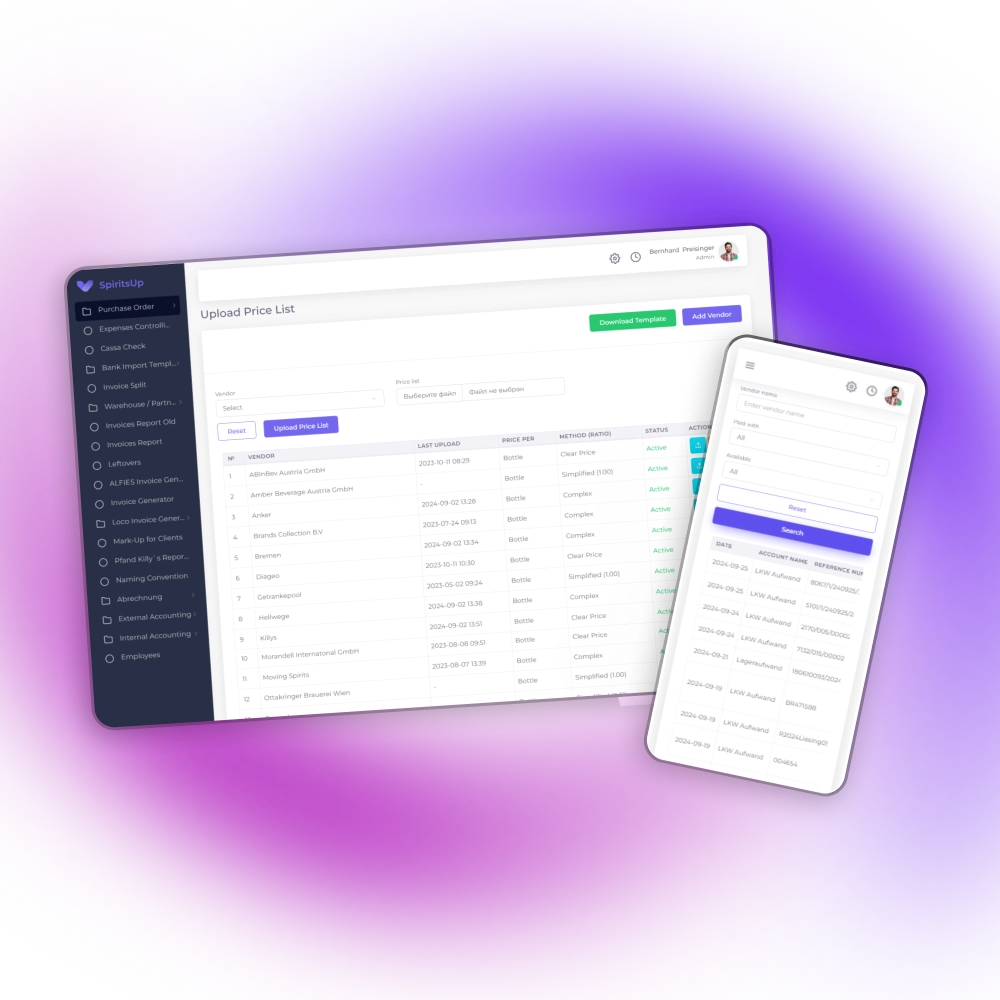

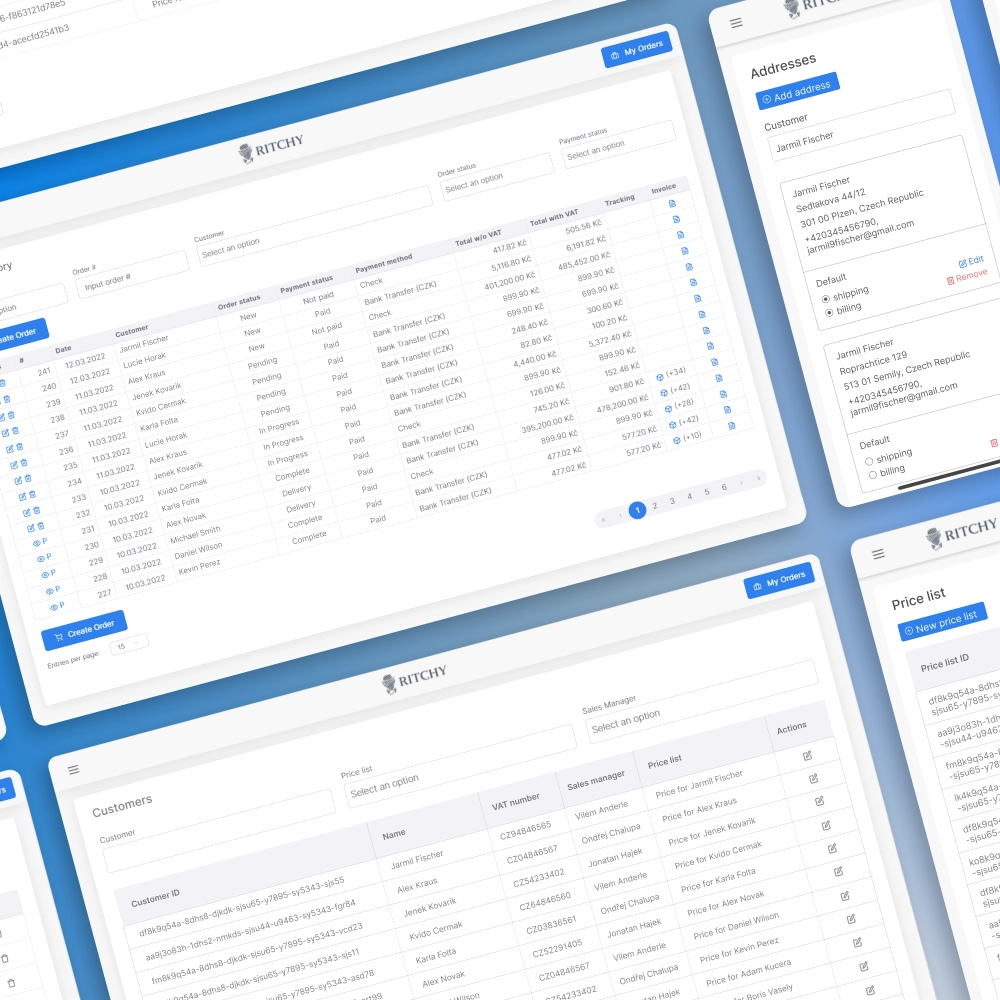

AvadaCRM develops CRM solutions for accountants and financial managers, taking into account industry specifics, legal requirements, and internal business regulations. We create systems that are easily adapted to specific company processes and integrate with accounting software, banking services, and ERP systems, providing a unified digital space for financial management.

AvadaCRM CRM helps reduce errors, speed up financial transaction processing, and increase data transparency, allowing accounting and finance departments to focus on analytics and business development rather than routine tasks.

What is CRM for accountants?

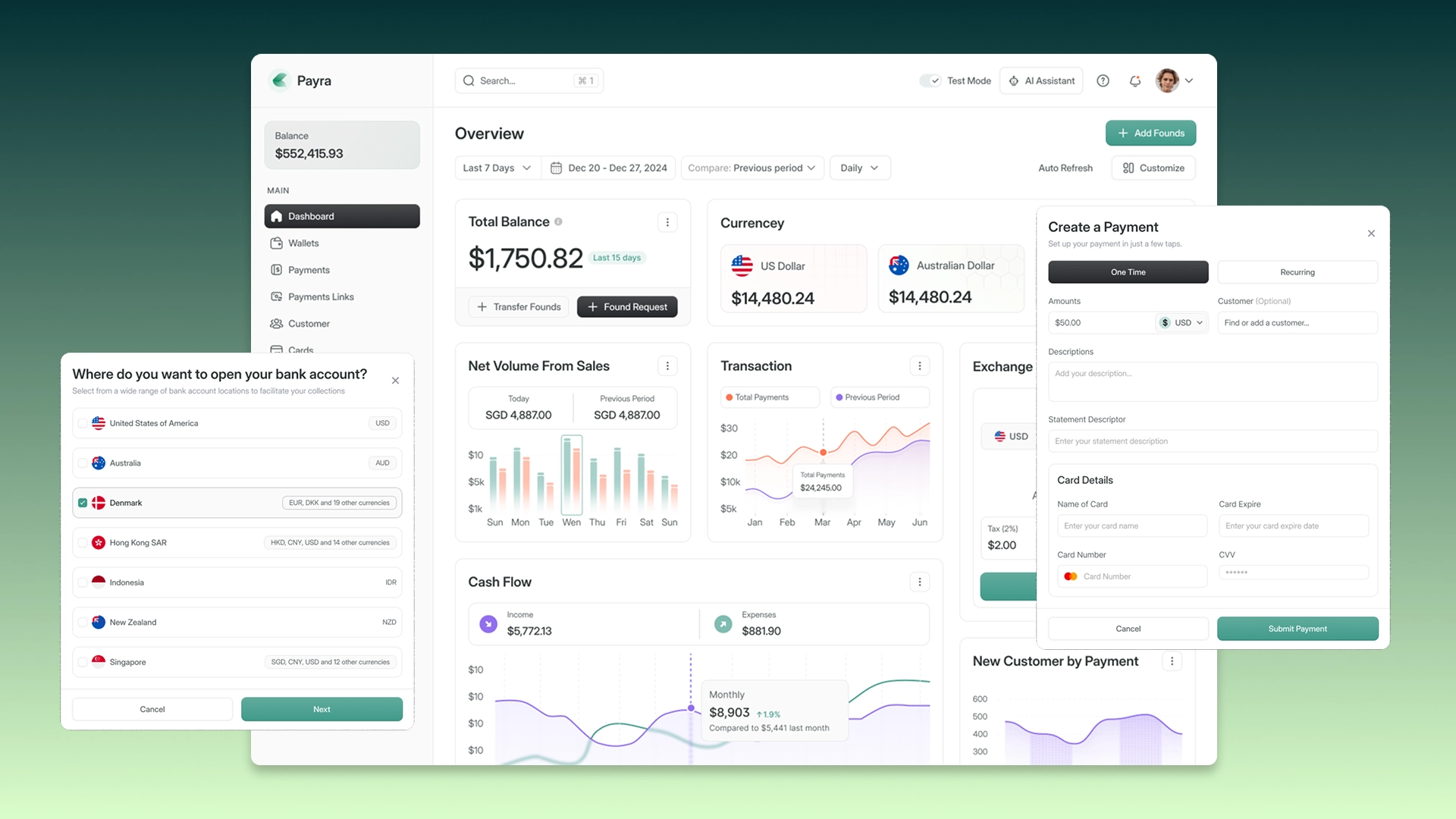

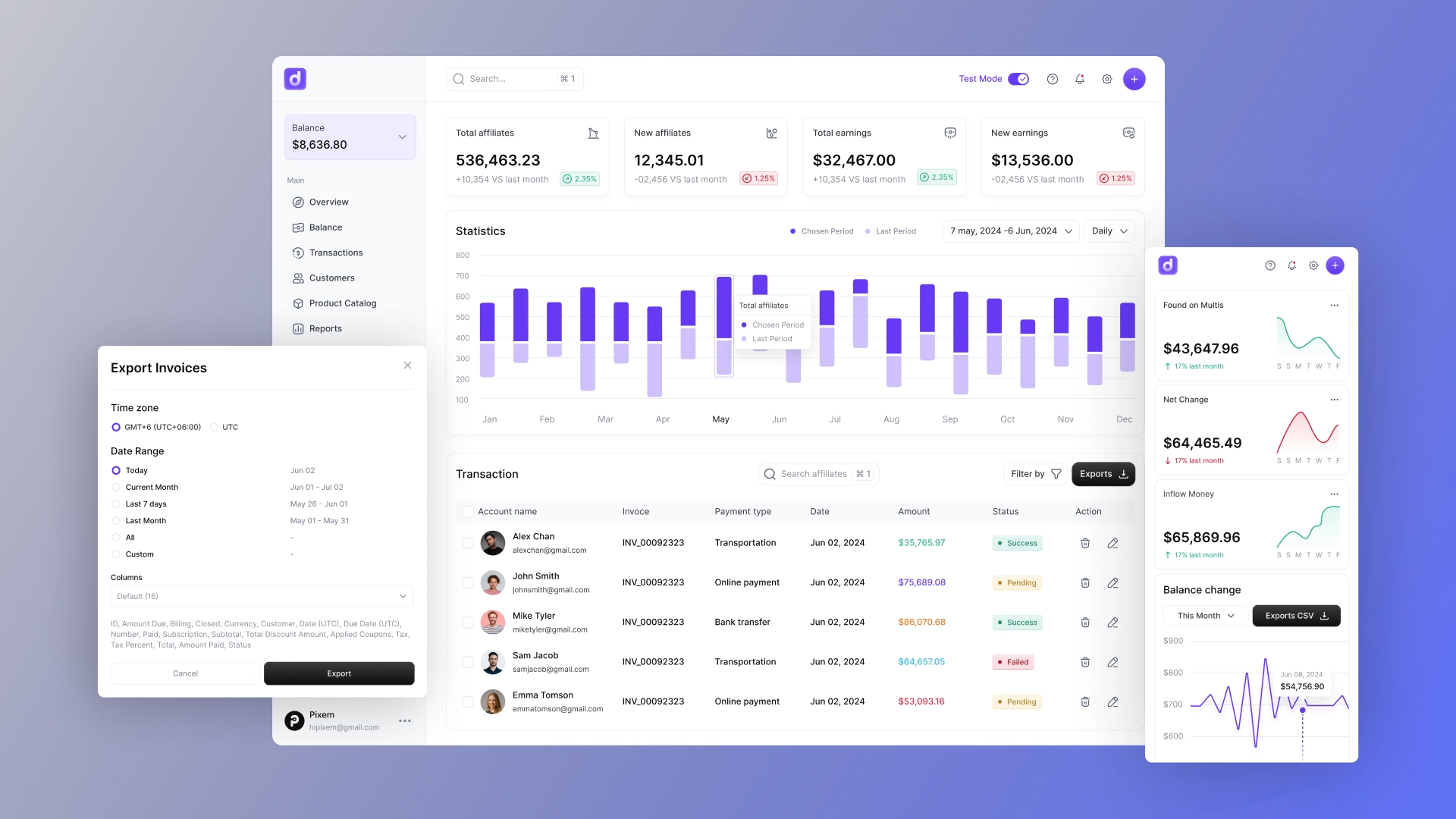

CRM for accountants and financial accounting is a specialized data and process management system that integrates financial information, clients, contracts, invoices, payments, and reporting into a single digital space.

Unlike classic CRMs, which focus solely on sales, accounting CRMs focus on financial processes: income and expense tracking, payment control, contract management, settlements with clients and contractors, and the preparation of financial and management reports.

This CRM can be used by accounting firms, outsourcing firms, corporate finance departments, and individual accountants. The system provides centralized data storage, reduces errors, simplifies tax and regulatory compliance, and increases the transparency of financial transactions.

CRM for accountants easily integrates with accounting software, banking services, ERP systems, and payment gateways, creating a unified solution for comprehensive financial accounting and management.

CRM capabilities for finance and accounting

CRM for financial and accounting management opens up even more new opportunities for companies:

Lead management

- Receipt through online and offline channels

- Referral Lead Management

- Lead qualification based on company size, industry, location, interest in accounting services, interactions with the firm's website, etc.

- Automated lead distribution and prioritization based on predicted conversion probability

Storage of customer data and documents

- Segmentation of clients based on the type of accounting services they are interested in, size/type of business, etc.

- Storage of documents (service contracts, invoices, tax invoices, etc.).

- Detect and merge duplicate customer data.

Customer Interaction Management

- Multichannel customer communication

- Automated email distribution

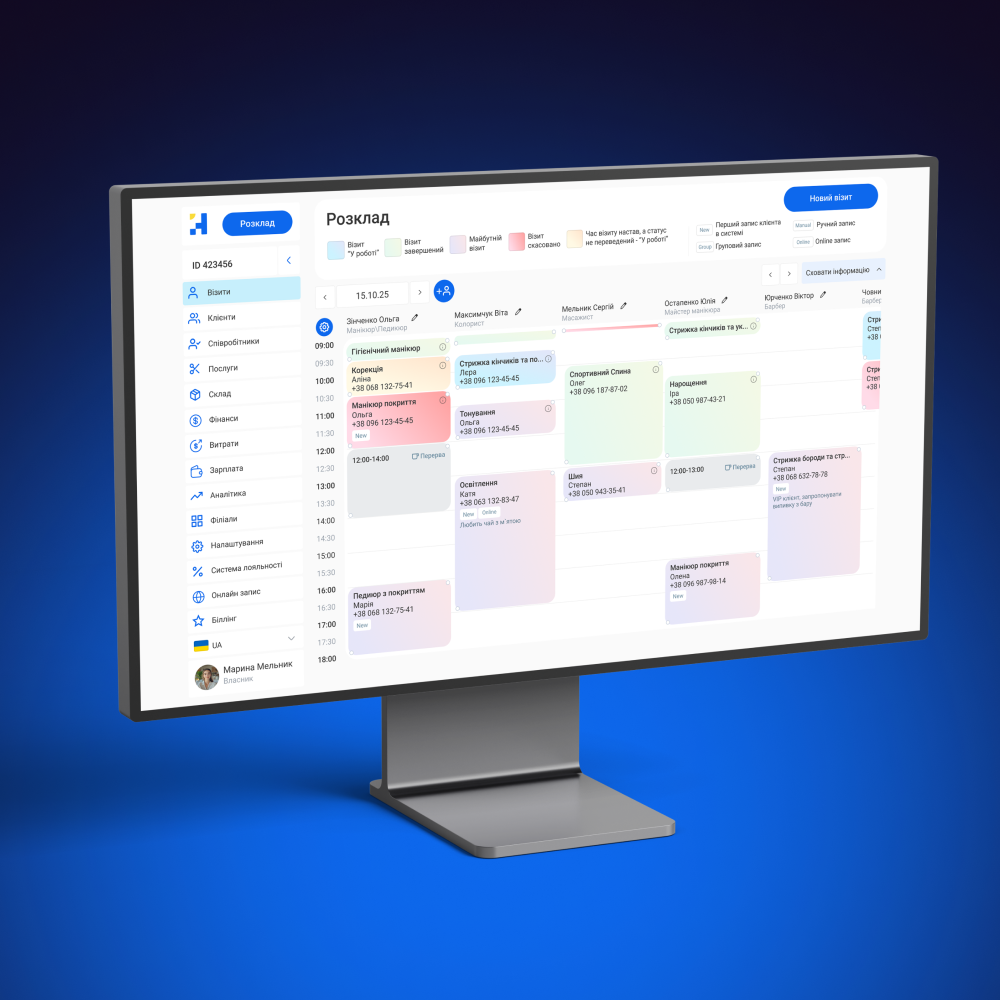

- Activity calendar, task calendar

Safety

- User activity logs

- Data backup

- Compliance with key regulatory requirements related to GDPR, etc.

Self-service for customers

- Client Portal

- A client information database (with descriptions of accounting services and prices, guides and tips on effective accounting processes, etc.)

- Chatbots for handling frequently asked customer questions

Optional control

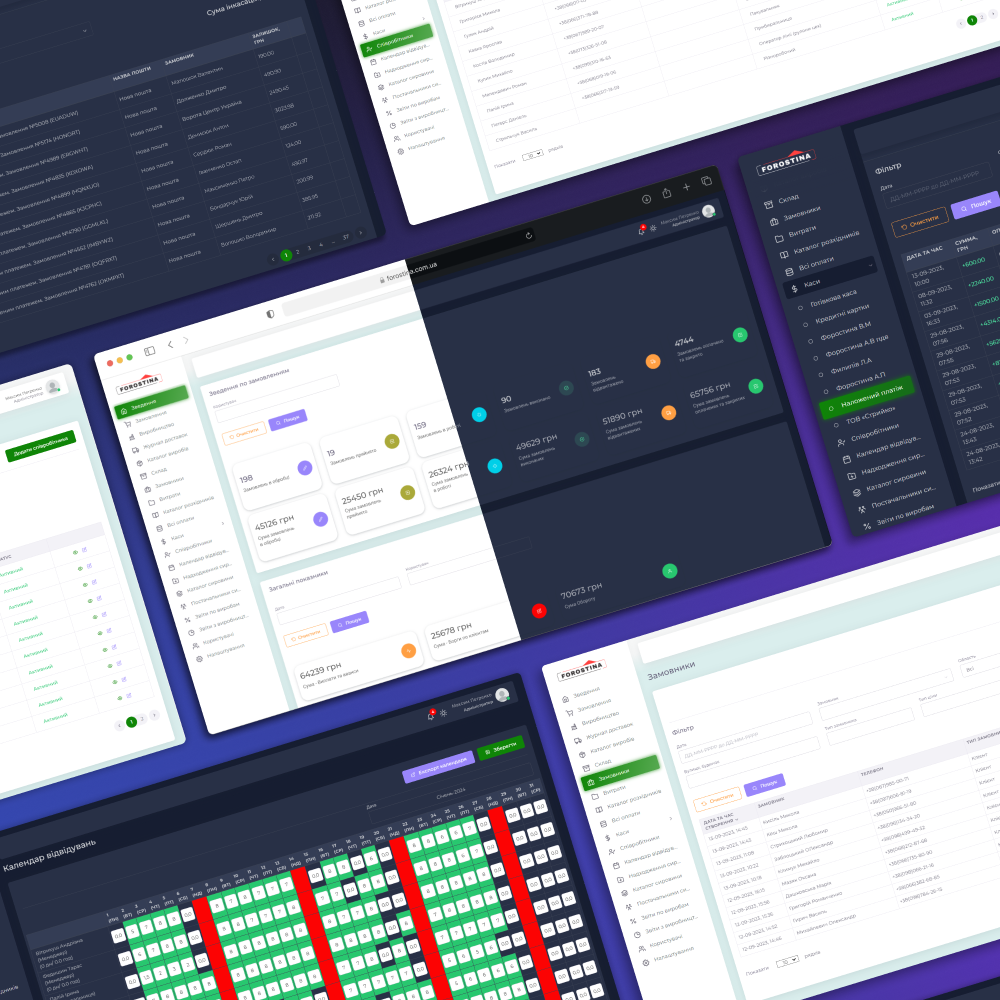

- Project management (defining project scope, tracking project progress, assigning project tasks to managers and accountants, creating task templates)

- Managing client documents (adding electronic signatures to documents, verifying the authenticity of client electronic signatures, setting up standard document templates, automatically filling in data in document forms)

- Time tracking (for billing clients based on the time accountants spend on projects)

Analytics and reporting

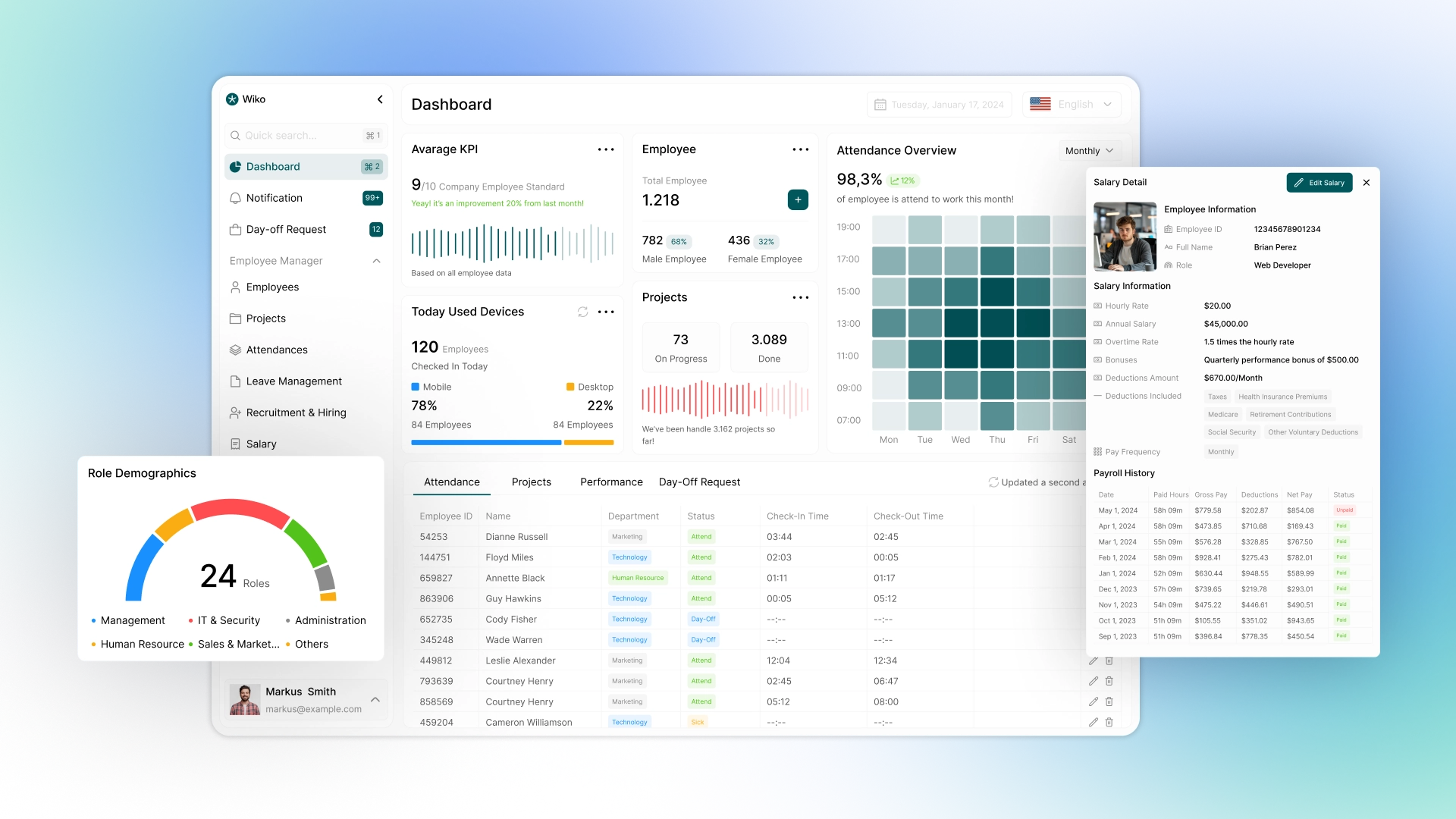

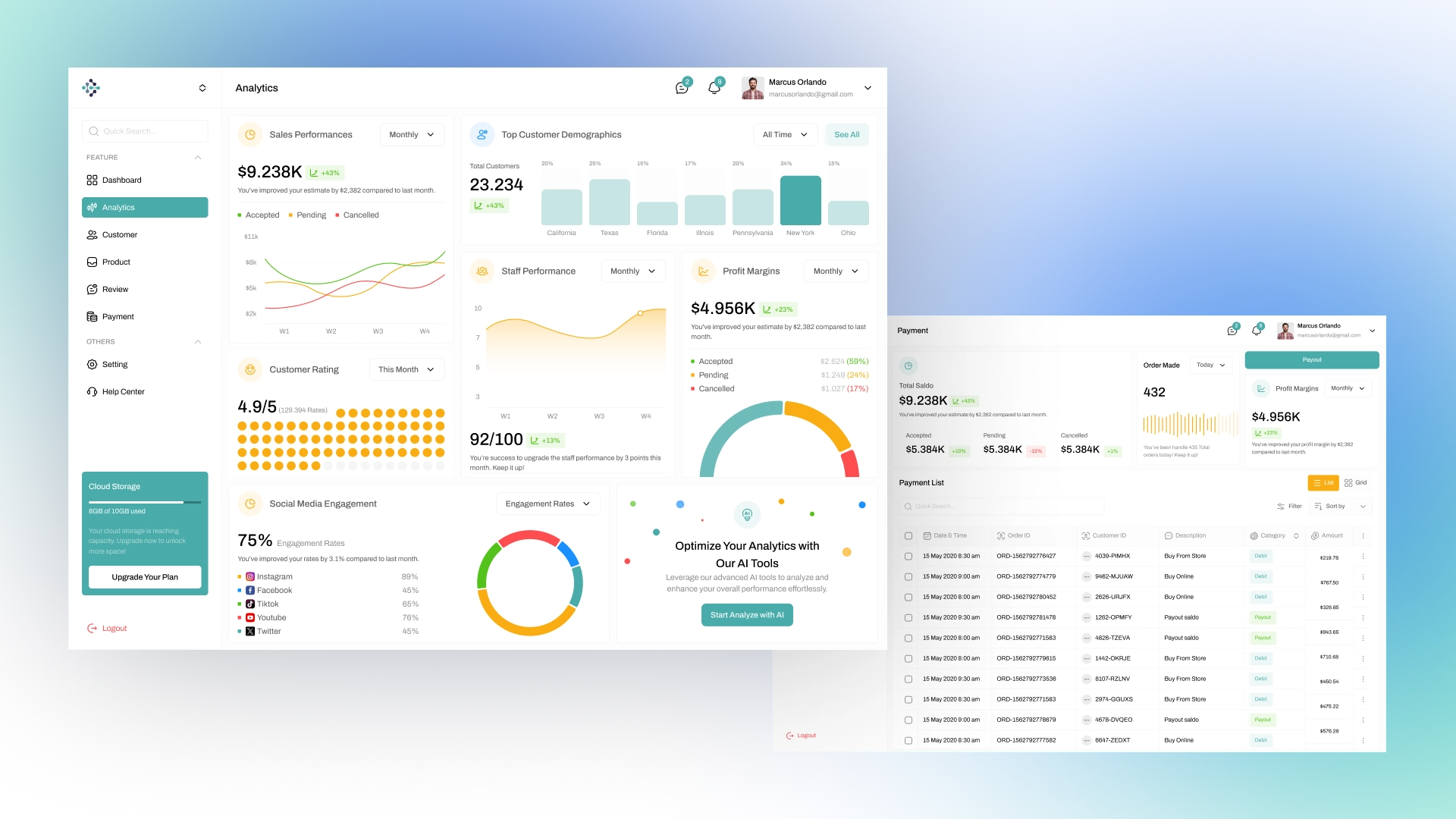

- Customizable dashboards and reports

- Tracking and analyzing KPIs (customer satisfaction rate, customer churn rate, average revenue per customer)

- Profitability and customer value analysis

- AI-powered cross-selling recommendations for accounting services (based on customer purchase history)

Features of CRM system development

When developing a CRM for accounting outsourcing, various technologies and frameworks can be used. The optimal stack depends on the functions the future platform will perform and the client's desired tasks.

- Web version. Any device and operating system with a browser can be used to run the CRM on the web platform. The frontend is implemented using HTML and CSS or reactive technologies such as React.js and Vue.js. The backend can be developed using Python, PHP, their frameworks, or Node.js and Java.

- Mobile application. The backend of a mobile application and a web system can be identical. The frontend is developed using the cross-platform Flutter framework or native technologies—Kotlin and Java are used for Android, and Swift is used for iOS.

Stages of developing a CRM system for an accounting firm

Step 1. Collecting information

To gather the necessary information, analysts turn to the analysis of solutions already present on the market and conduct meetings with the client.

Step 2. Design and technical documentation

Specialists work on developing technical documentation, which includes a mockup (a prototype of the future system), a full description of the functionality being developed, a technology stack, and a work plan. The project's timeline and cost are calculated based on this documentation.

Step 3. Design

A highly concentrated set of features is essential for a multitasking tool like a CRM for accountants. UI designers are tasked with maintaining a user-friendly and intuitive interface, regardless of the scale of the customer relationship management system. Specialists create the system design entirely from scratch or use ready-made interface components. The latter option significantly increases the speed of implementation.

Step 4. Programming

The technical part of developing a CRM for an accounting firm is the most complex and labor-intensive stage, divided into two components:

- Frontend. Designing the user interface for interactions with end users, such as accountants or financial specialists. It creates a corresponding closed loop of receiving a request, sending it to the server, and then displaying the result. Implementing the frontend using HTML and CSS takes less time than developing with reactive technologies like Vue.js or React.js, and is a less expensive option.

- Backend. Development of the CRM server component, which is responsible for processing incoming requests, working with databases, and interacting with external APIs.

Step 5. Testing and Deployment

After the technical development of the CRM is completed, thorough testing is carried out, which includes the following criteria:

- Correct operation of the functionality

- Compliance of the project with the initial plans

- System performance

- Data security

- Ease of use

- The project is returned for revision if bugs are discovered and then retested. This ensures that the bug has indeed been fixed and that the changes made do not disrupt other functions.

The ready-made CRM for an accounting company is hosted on a public server and made available to users. Afterward, the developers communicate with your employees and train them on how to use the new software.

Technical production of CRM systems for accountants and financial accounting

AvadaCRM has extensive experience developing financial accounting software. We conduct business analysis, identifying the company's specific characteristics and goals, its structure, and focusing on the goals and objectives of the CRM system itself.

Our company designs and develops user-friendly and multifunctional turnkey CRM systems for enterprise-scale businesses. Our team of experienced specialists, using modern technologies, can implement projects of any complexity.